Rotate shares e-commerce insights and market outlook at EU cross border e-commerce forum

10 September, 2024

This week Ryan Keyrouse, CEO at Rotate, shared insights and expectations on the global e-commerce market with 450+ delegates at the EU Cross-Border e-commerce Forum in Liege, Belgium. The analysis leveraged Rotate’s Live Capacity data and showcases Rotate’s recently developed air cargo demand data product – a holistic view on the market that uniquely provides insights on e-commerce.

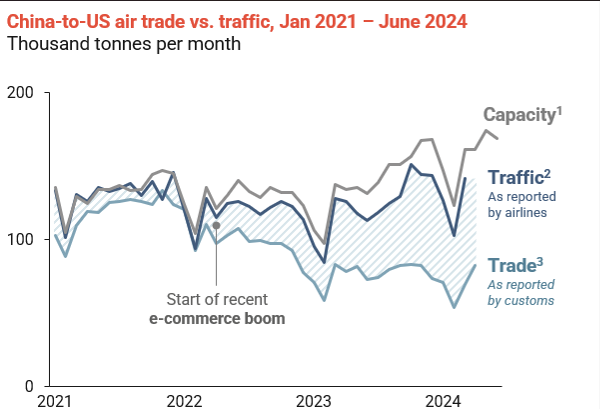

Highlighting the phenomenal growth of e-commerce out of China in the last two years, Rotate’s materials revealed that growth is no longer concentrated solely in the southern province of Guangdong (+15%) but rather in other provinces (+37%). Capacity data supported this trend, showing China’s secondary airports out-performing, as airlines increasingly operate dedicated e-commerce freighters to these airports. This also means the share of e-commerce transported via mail has dwindled.

It is not only the origin of e-commerce that is diversifying. While China to the United States and Europe indeed experienced the largest tonnage growth over the last two years in absolute terms, China to Malaysia and Mexico combined added as many e-commerce tonnes as Europe – with YoY growth rates of 46% and 73%, respectively.

Ahead of the forum, Rotate surveyed the 450+ delegates on various e-commerce trends. This revealed several inconsistencies between industry perception and the data. For example, while half the delegates believed e-commerce growth came on top of a growing general cargo market, trade data indicates the general cargo market over the last two years was flat at best. The survey also revealed the biggest risks to e-commerce growth was not changes to De Minimis thresholds, but rather security concerns from misdeclarations and politically motivated policies.

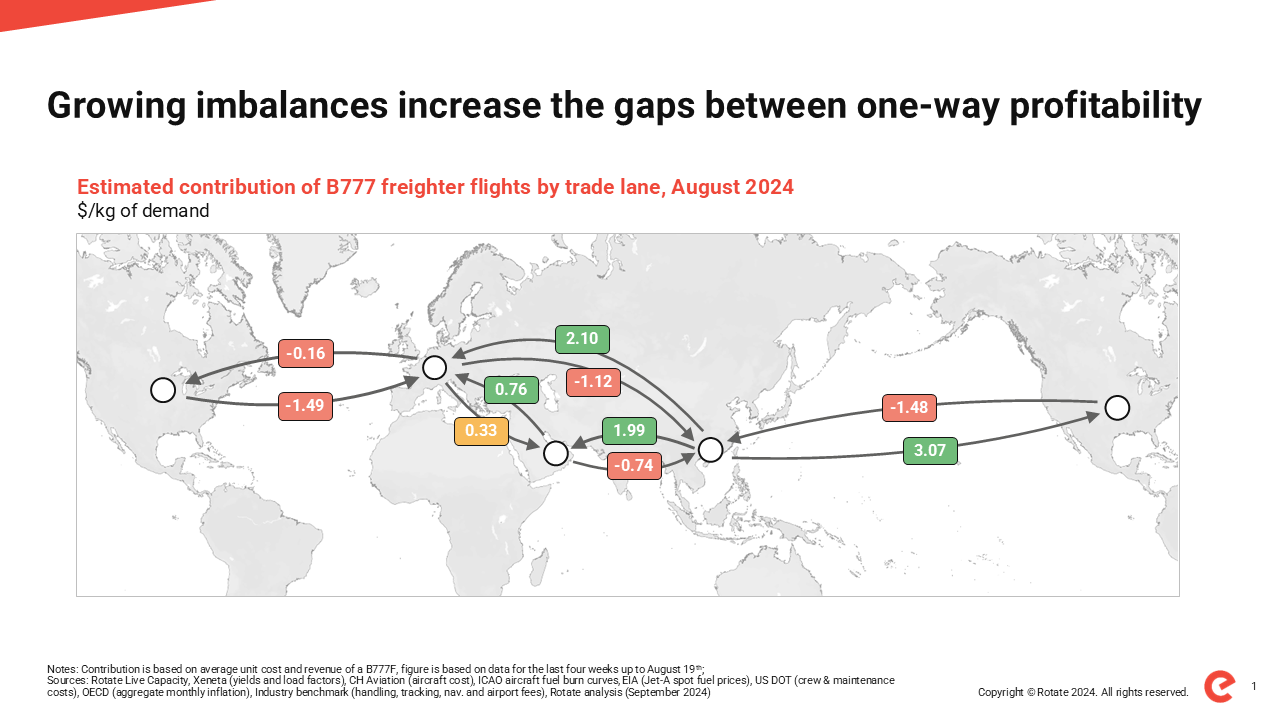

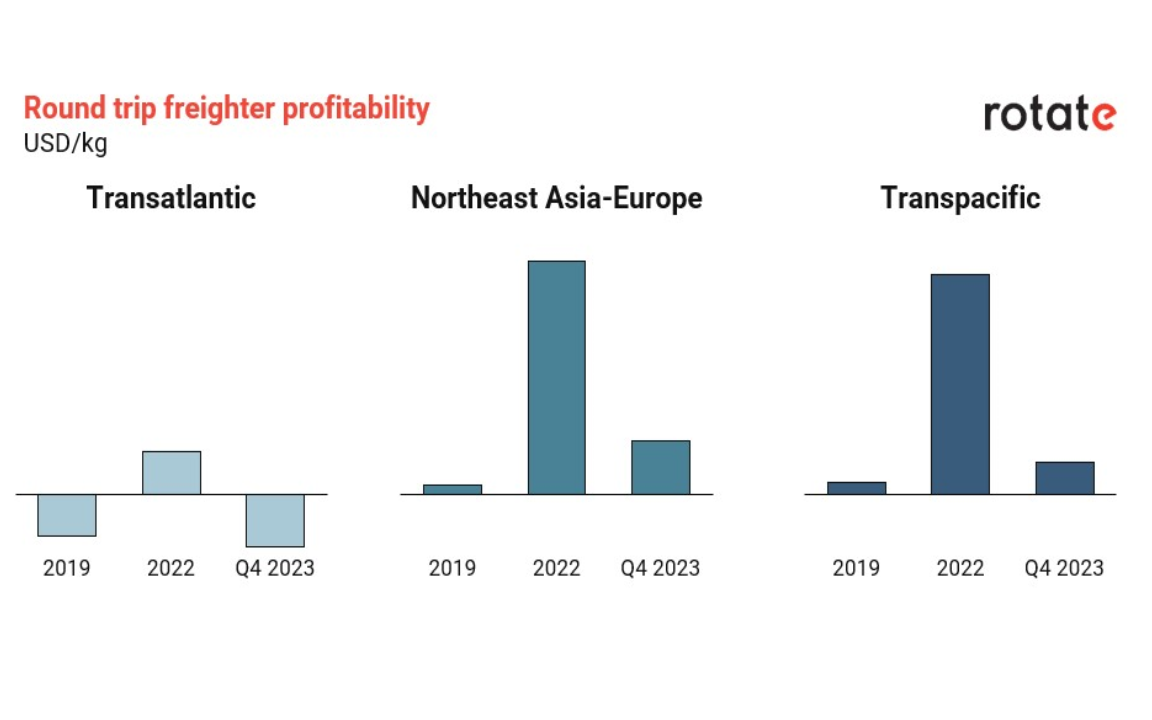

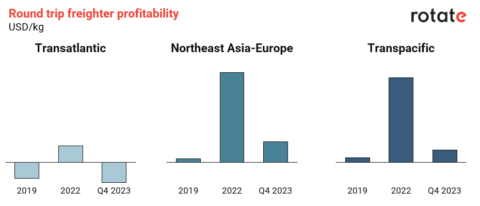

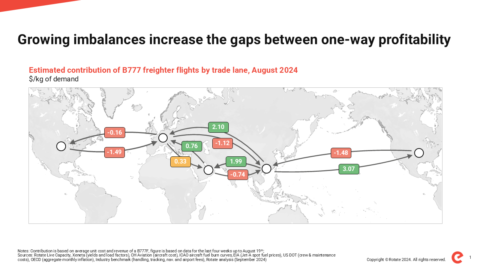

When asked what drives operational issues, respondents again pointed to misdeclarations along with the digital constraints from so many small packages, unprepared airport facilities and staff, and unbalanced flows. The growing imbalances leads to increasing gaps in one-way freighter profitability.

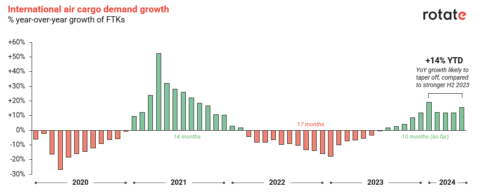

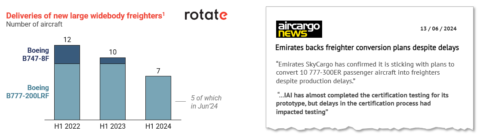

Looking ahead to 2025, Mr Keyrouse discussed a range of possible market scenarios. Delegates were split between e-commerce continuing its aggressive growth and maturing to a more moderate growth, while a small minority thought e-commerce volumes had peaked. This positive outlook would put the industry in uncharted territory – setting records for consecutives months of growth – but also leaving the industry wondering how much the available capacity will constrain demand growth given deliveries and conversions are limited and the utilization of freighters is still near its peak.

Reflecting on the forum, Mr. Keyrouse remarked “We have all seen bits of this data in the past – so it’s exciting to have finally combined various data sources to build the first holistic view of demand. It is something we have wanted to build for a long time – and more is coming soon.” Rotate is currently continuing the co-development of its demand data products together with customers and invites interested companies to reach out to learn more about this unique approach to air cargo demand data.

About Rotate:

Rotate is transforming the air cargo industry by enabling better commercial and strategic decisions through data-driven consulting and proprietary software and data products. It empowers industry professionals to convert data into action and create substantial value. With offices in the Netherlands and Malaysia, its team of ~35 strategy consultants, air cargo specialists and technology professionals, is dedicated to creating real and practical solutions and strategies.

Having successfully completed over 400 engagements with more than 100 clients, Rotate staff have made a significant impact in the air cargo sector. They developed software and optimization software trusted by airlines that together represent 40% of the global air cargo market. Rotate’s recently launched Sales Cockpit is being utilized by industry leaders such as Etihad Cargo and Air Canada Cargo.

Rotate is a proud member of CargoTech, a consortium with the mission to encourage, facilitate, and accelerate the digital transformation of the air cargo industry. It aims to be a one-stop-shop, offering digital solutions for every air cargo business process, and providing best-in-class digital transformation consultancy services to air cargo stakeholders.

For press or media enquiries, please reach out to Jonathan Mellink, Head of Sales and Marketing: jonathan@letsrotate.com